Student Loan Crisis: A Growing Problem That Will Soon Hit Credit Scores

Student Loan Mayhem: How Did We Get Here?

First, let me give you some brief context about how we got here…

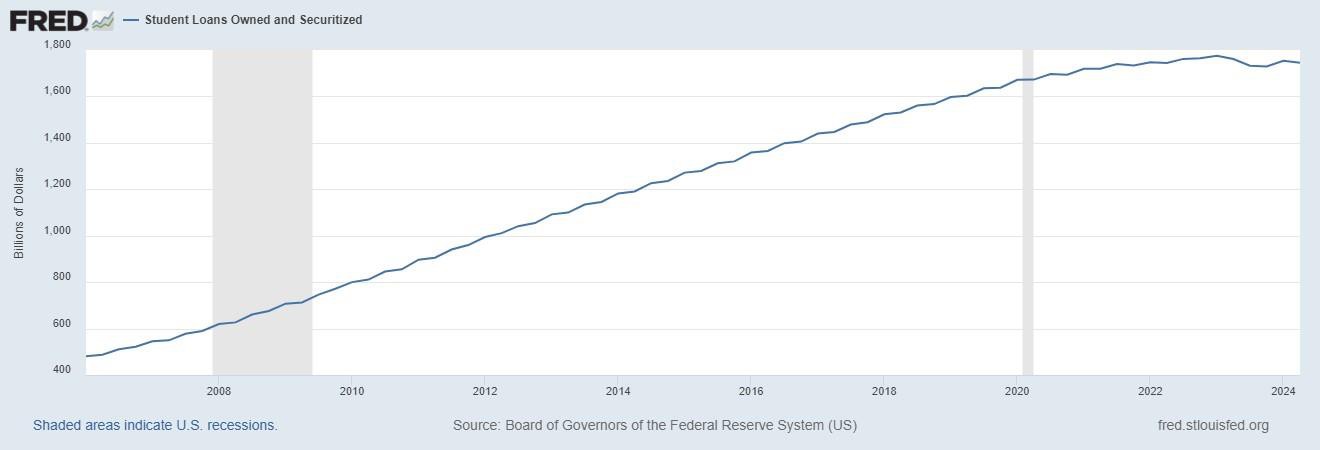

As of Q1 2024, the student loan crisis has reached staggering levels, with student loan debt totaling $1.75 trillion1, mostly driven by federal student loans.

Figure 1: St. Louis Federal Reserve Bank, September 2024

We believe much of this surging student debt stems from the federal government’s aggressive backing of loans since 2010, which has fueled the current student debt crisis and created what’s known as a moral hazard.

- For example, moral hazard is when banks make excessively risky loans because they know they’ll be bailed out by the government if things go wrong.

With loans guaranteed by the government, lenders had no incentive to assess whether borrowers could repay. Colleges - seeing the easy flow of money and new entrants – could raise tuition, knowing students had access to federal funds to pay for their college.

Borrowers, in turn, took on more debt than they could manage, contributing to the $1.6 trillion in federally backed student loans we’re grappling with today. This cycle of government backing, easy credit, and rising costs drove the rapid growth of student loans.

- To put this into perspective, student debt has exploded roughly triple since 2006.

The point here is that there’s compelling evidence suggesting that the government’s backing of loans has amplified the student debt crisis (though it's important to note that this remains up for debate).

But after COVID-19, the situation worsened, and now it may lead to even more unintended consequences.

Student Loan Repayment Pause: How COVID-19 Policies Only Masked The Crisis

Student debt was already a big problem. But what the government did after 2020 made it potentially worse.

See, after COVID hit, student loan repayments were "temporarily" paused as a form of stimulus. Borrowers got a break, keeping more money each month instead of paying debt. The federal student loan payment pause began in March 2020 under President Trump’s CARES Act, with interest set to 0%. It was supposed to last six months but was extended several times by President Biden.

Finally, after more than three years, repayments resumed in October 2023. To ease the transition, the Department of Education2 introduced a 12-month "on-ramp" until September 30, 2024. During this time, missed payments won’t harm credit scores, cause defaults, or trigger collections. But interest will keep building.

But here’s the kicker. . .

After two more weeks – once September 2024 ends - these missed payments will affect credit again and could lead to wage garnishments or collections.

Will Missed Student Loan Payments Crash Credit Scores?

The end of this grace period poses a financial strain - especially at a time when households are already struggling with other debts.

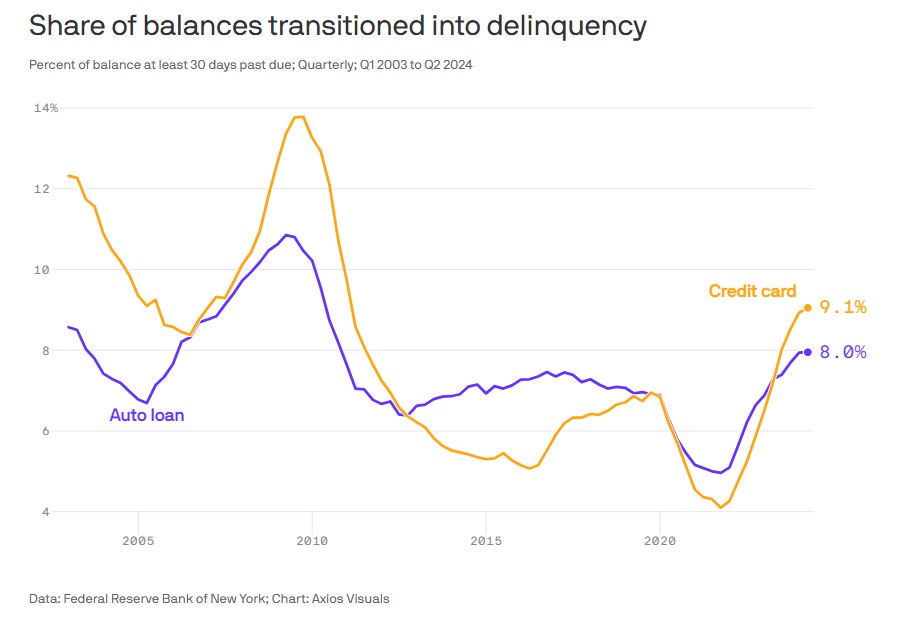

To highlight this point - households missing credit card and auto loan payments are surging at alarming rates, reaching their highest levels since the 2008-2011 financial crisis4.

Figure 2: AXIOS, August 2024

But unlike then, when delinquencies were declining by 2011 as household balance sheets improved, this time they are rising again - much like they did in the lead-up to the 2007-2009 recession.

- This signals that financial stress across households is getting worse, not better.

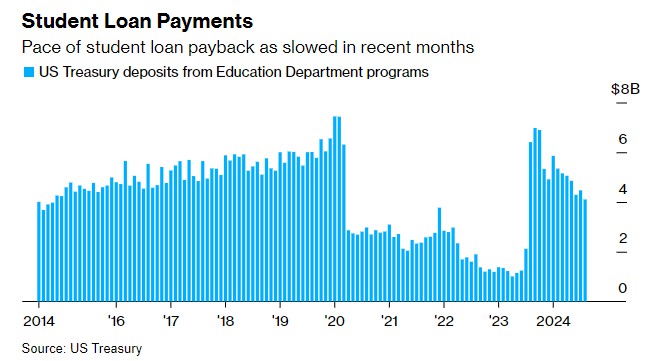

Why does this matter? Because student loan payments have been slowing all year5 and remain well below pre-pandemic levels…

Figure 3: Bloomberg, September 2024

And when combined with rising delinquencies in auto loans and credit card payments, it shows us that consumers are already overburdened.

All this debt pressure implies that many households are struggling to keep up with paying their debts, signaling deeper economic stress ahead.

- And don’t forget—the labor market is cooling rapidly, which could intensify this burden, especially as inflation continues to erode real incomes.

To make matters worse, missed student loan payments will start being reported to credit agencies next month.

So, how big is this problem?

Well, according to the recent report from the Government Accountability Office (GAO)6, out of the 44 million borrowers, 10 million - or roughly 25% - were behind on payments as of the end of January 2024.

And of those, two-thirds were more than three months late - meaning they were seriously delinquent and at risk of default or collections.

- Long story short, student loan delinquencies are rising at a troubling pace for many Americans.

This data will soon hit the credit reports after being underreported for years, and it’s happening at a time when households are already stretched thin.

Talk about a mess, right?

But it gets worse when you grasp how misleading FICO scores may have become.

The Hidden Risk of “FICO Inflation”: How Pandemic-Era Policies Masked True Financial Health

Have you heard of FICO-flation? It's a lesser-known but serious issue, so let’s break it down.

FICO inflation refers to the sharp rise in credit scores during the COVID-19 pandemic, largely due to government stimulus and reduced credit usage. Stimulus checks, forbearance, and paused payments for mortgages and student loans allowed borrowers to pay down debt - especially credit cards - more than they otherwise would have been able to, thus temporarily boosting their scores.

- Put simply, government handouts during the pandemic artificially inflated FICO scores

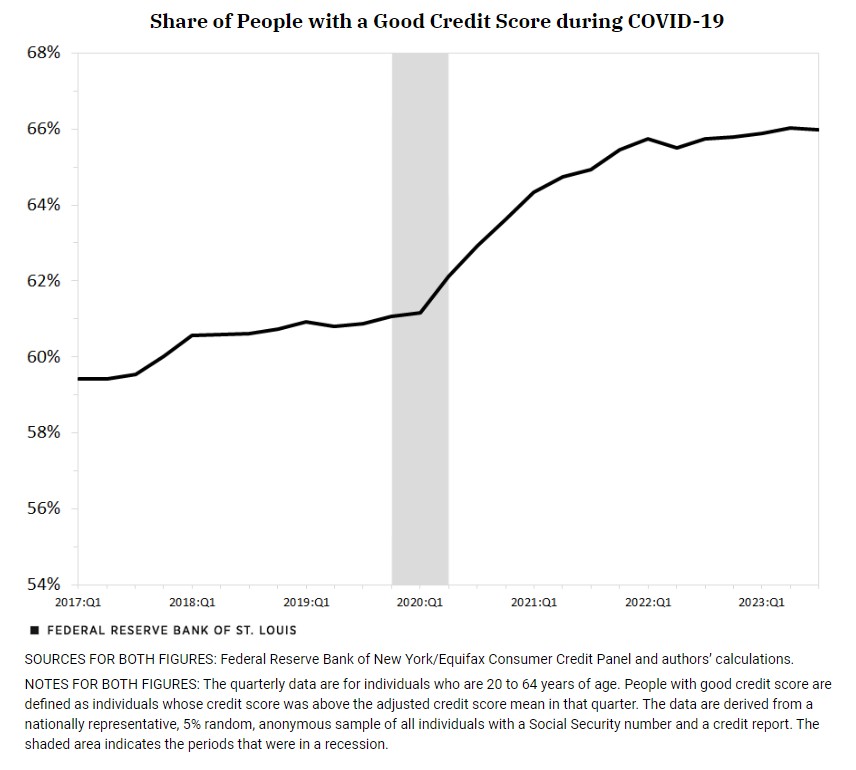

Take a look at data from the December 2023 St. Louis Federal Reserve report7 – highlighting the surge in “good” credit ratings post-COVID.

More importantly, households with lower credit scores saw the biggest gains - moving from subprime to higher credit tiers.

And while the mainstream touts this angle, it’s also a fact that the rise was driven by government aid, not organic financial gains.

Now that pandemic relief has ended, many inflated FICO scores no longer reflect borrowers' true financial health.

- For instance, a borrower with a 725 score post-2020 might have looked more creditworthy than they actually were, but without government aid, their score could have been closer to 675.

Thus, as missed student loan payments are reported again - combined with rising delinquencies in credit card and auto loans - we may see a significant drop in FICO scores.

And I believe the bigger issue is that lenders might not fully understand the true credit risk they face until defaults surge, and by then, it could be too late and cause further banking issues.

Just Some Food For Thought

The student loan crisis isn’t just about missed payments - it’s another symptom of the debt plague infecting our entire financial system. From student loans to credit cards, the disease keeps spreading.

Each compounding debt payment slowly eats away at disposable income (aka take-home pay), forcing households to either cut back on spending or take on even more debt - both of which have negative consequences.

Now, as student loan repayments (or non-repayments) begin affecting credit scores again, the cracks in household finances are becoming more visible.

As FICO scores normalize and defaults rise across all major types of non-mortgage debt, the impact could ripple across the economy - hitting consumer spending, economic growth, and even the banking sector.

So, I believe, the real question isn’t whether there will be fallout, but how severe it will be.

As always, time will tell. Take care.

Sources:

- Average Student Loan Debt: 2024 Statistics | BestColleges

- IF12472 (congress.gov)

- Student Loan Debt Statistics [2024 Data] (thecollegeinvestor.com)

- Credit card, auto loan delinquency rates tick up (axios.com)

- Americans Face Credit Hit as Student Debt Goes Delinquent Again - Bloomberg

- Federal Student Loans: Preliminary Observations on Borrower Repayment Practices after the Payment Pause | U.S. GAO

- What Drove the Growth in Credit Scores during the COVID-19 Pandemic? (stlouisfed.org)